Handling Payment moratoriums

The Year 2020 was an unprecedented year in terms of crisis in the world. The pandemic threw the entire world in a state of "suspended animation". Financial Institutions were faced with the challenge of offering moratoriums in their lending programme to borrowers. Though offering a moratorium isn't a problem for an institution, handling it in the lending system and applications can be a challenge.

Lets take an example of a Home Loan of Rs. 50 lakhs at 8.5% per annum provided to Mrs Madhavi Prabhu and Mr. Prabhu to purchase a flat in Tiruchy. The loan facility is for 20 years and the repayment schedule is drawn on an EMI based on arrears. Let us assume that the first EMI was to be paid on April 2019.

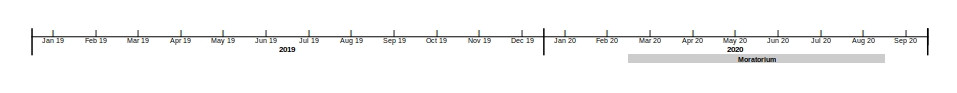

The couple paid their EMI's regularly for a year till the pandemic struck in March 2020. The RBI recommended that banks provide a moratorium on term loans and Working capital loans to their customers. This moratorium applies for three months for the instalments falling due between 1st March 2020 to 31st May 2020. It was subsequently increased by another three months to 31st August 2020. The repayment schedule for such loans as also the residual tenor, will be shifted across the board by three/six months after the moratorium period. However, Interest shall continue to accrue on the outstanding portion of the term loans during the moratorium period. Which means that in case of Mrs. Madhavi Prabhu and Mr. Prabhu their loan which was scheduled to end on March 2039 if paid regularly will now be extended by three months to June 2039 or September 2039. The moratorium increases the period of liability from 240 months to 243 or 246 months.

However it is not as simple as just increasing the tenor because As a banking practice, when interest is not paid it shall be capitalized (means added to the balance loan amount) thereby the loan amount increases. In the beginning of the loan tenure the interest component makes up a large portion of the EMI, so opting for the moratarium would mean that the unpaid interest for three months will be added to the principal and would result in eleven additional EMI's which means the Mrs Madhavi Prabhu and Mr. Prabhu will have their loan tenure increased to 251 months! If the couple were to opt for a moratorim of six months the capitalisation of unpaid interest would result in an increase in principal and an increase in the tenure by twenty two months so the loan tenure would be increased to 262 months. However the impact is not significant if the borrower is at the end of the repayment tenure as the principal forms a significant portion of the EMI.

In the lending application in the bank the treatment depends on the way the applications are configured. Some of the applications that were developed when "Fixed Interest" was popular draw up the repayment schedules when the loan contract is drawn up. In such cases the lending application amortises the interest component every day during the "end-of-day" process and creates a due on the EMI due date. In such cases the lending application has to be tweaked to debit the customer ledger with the overdue interest amount on the EMI due date to capitalise the unpaid interest. This would also mean that the repayment schedule has to be redrawn with an EMI or tenure increase and sent to the customer.

Some lending applications do not draw up the repayment schedules upfront instead they compute the interest only when due that is on the repayment due date. In such cases the computed interest has to be debited to the customer account and at the end of the moratorium period the EMI or the tenure has to be increased and a communication has to be sent to the customer.