An easy way to Compute Processing and Other Charges in your lending program

As part of a lending program, there are several charges that will be required to be computed. For example a Mortgage facility requires the following charges to be computed on the sanctioned amount.

- Life Insurance Premium

- Property Insurance

- Login Fees

- Processing Fees

- MODT Charges

Looking at these charges we can notice that

- Life Insurance premium is based on the age of the borrower

- Property Insurance is based on the value of the property

- Login fees is a fixed amount

- Processing fees is based on the sanctioned amount

- MODT charges is based on the sanctioned amount

During the life time of a loan account additional charges have to be computed. So the charge computation mechanism has to cater to these various ways of computing charges. During the course of our implementations we have gathered several different ways in which charges are computed and put these in amn Open Office Spread Sheet.

Featured Resource

Download Now : Charge Calculator Template (OpenOffice Spreadsheet)

Percentage

This is the simplest mechanism of computing charges. The charge is usually a rate applied on a spcific amount like for example the Principal of the loan amount. It is usually used to compute the processing fees. So if the processing fees is 0.5% and the principal is Rs. 20,000 then the Processing fees to be paid by the borrower is Rs. 100.

Percentage with minimum applicable charge

However the percentage mechanism can come with a rider i.e. a rate subjected to a minimum charge that is applicable. So if a minimum charge specified is Rs. 450 then the charges are computed as follows. Compute the charge percentage, compare it with the minimum charge applicable if the amount is lesser, then the minimum charge is applicable otherwise the computed charge is taken. In our case if the Principal is Rs. 20,000 and rate is 0.5% then the computed charge of Rs. 100, which is lesser than the minimum charge of Rs. 450 so Rs. 450 is taken as the processing fees.

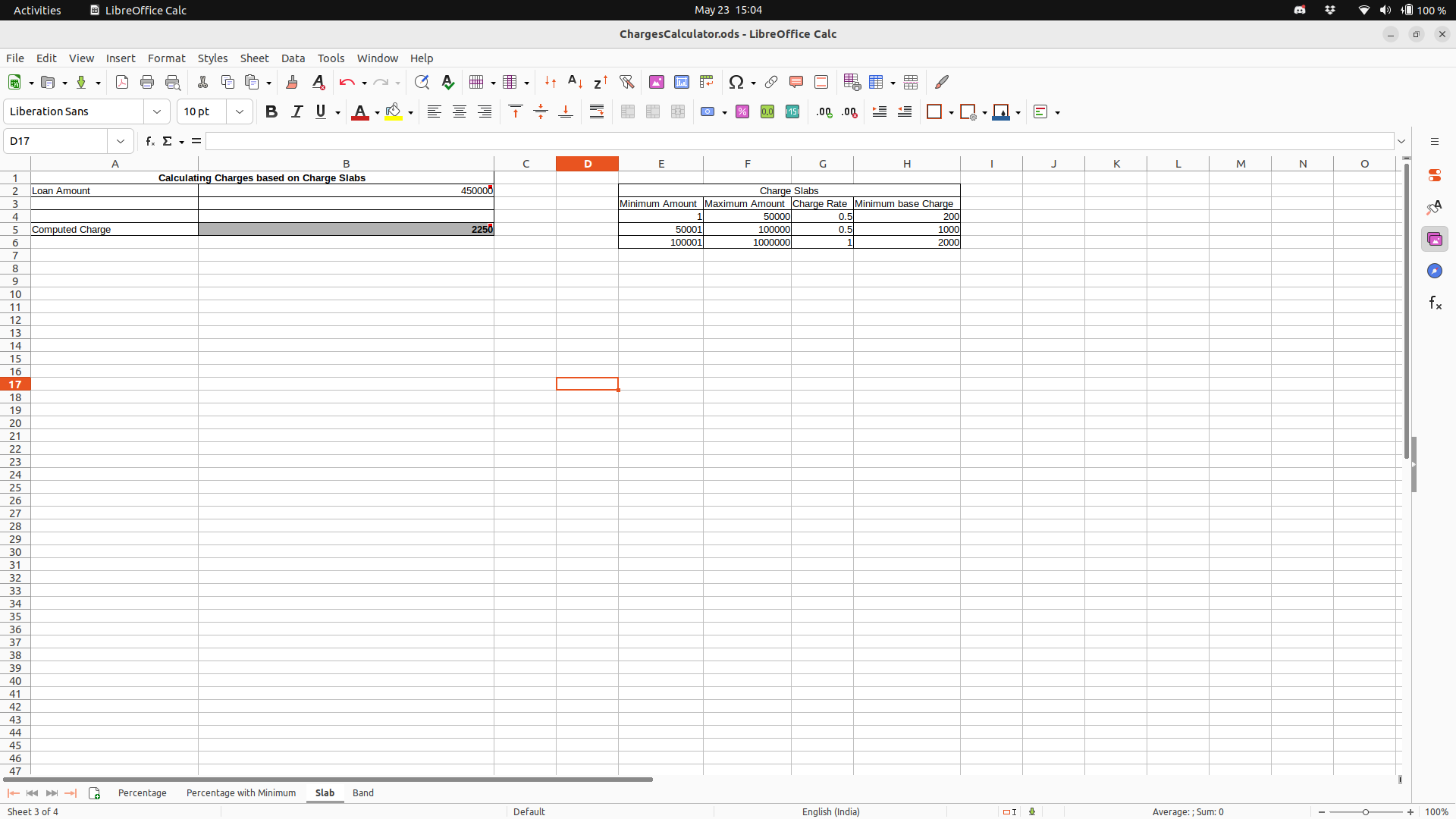

Slabs

In the Slab method charges are defined as slabs. While computing the charges the amount on which the charge is to computed is compared against each of these slabs to determine the charge rate that is applicable and the appropriate rate is picked up and used to compute the charge. Consider the following Charge Slab table

| Charge Slabs | |||

| Minimum Amount | Maximum Amount | Charge Rate | Minimum Base Charge |

| 1 | 50000 | 0.5 | 200 |

| 50001 | 100000 | 0.5 | 1000 |

| 100001 | 1000000 | 1 | 2000 |

If the Principal amount of the loan facility is Rs 4,50,000 then the processing fees is computed as follows. We look up the table and see that the applicable rate is available in the third slab. So we use 1 percent to compute the chare. So 1 percent of Rs. 450000 is Rs. 4500.

Slabs with minimum applicable charge

The Slab mechanism can also come with the minimum charge applicable rider. Consider a principal amount of Rs. 20000 in case of Micro Loan. In this case the rate applicable is 0.5 percent which is the first slab. At this rate we get a total charge amount of Rs. 100. Hoiwever since the Minimum Base Charge specified is Rs. 200 the applicable charge for the loan will be Rs. 200.

Bands

In the bankd method charges are defined as bands. While computing the charge the rate is applied from the first band progressively and the Amount on which the charge is computed is reduced by the maximum amount specified for that band. Consider the following Band table

| Charge Bands | |||

| Minimum Amount | Maximum Amount | Charge Rate | Minimum Base Charge |

| 1 | 50000 | 0.5 | 200 |

| 50001 | 100000 | 0.5 | 1000 |

| 100001 | 1000000 | 1 | 2000 |

If the Principal amount of the loan facility is Rs 4,50,000 then the processing fees is computed as follows. We scan the table progressively. First we compute the charge applicable for Rs. 50,000 at a rate of 0.5 percent which is Rs. 250. We then subtract Rs. 50,000 from the principal amount. This gives us Rs. 4,00,000. We then compute the charge for the next Rs. 1,00,000 at 0.5 percent which is Rs. 500. We now subtract Rs. 100000 from the remaining principal of Rs 4,00,000 which gives us Rs. 3,00,000. We pick up the rate from the third band, that is 1 percent and compute the charge and arrive at Rs. 3000. Since there is no more principle left to compute charge we now add up the charge amount of all these bands Rs. 250 + Rs. 500 + Rs. 3000 which gives a total charge of Rs 3750.

Bands with minimum applicable charge

The band mechanism can also come with the minimum charge applicable rider. Consider a principal amount of Rs. 75000 in case of Micro Loan. First we compute the charge applicable for Rs. 50,000 at a rate of 0.5 percent which is Rs. 250. We then subtract Rs. 50,000 from the principal amount. This gives us Rs.25,000. We then compute the charge for this amount from the rate specified in the first slab (as Rs. 25000 falls between the minimum ands maximum amounts in this slab) that is 0.5 percent we arraive at a charge amount of Rs. 125 which is lesser than the minimum Base Charge of Rs. 200 so we take Rs. 200. Since there is no more principle left to compute charge we now add up the charge amount of all these bands Rs. 250 + Rs. 200 which gives us a total charge of Rs. Rs 450.

Usually computer applications thar are used to process loans allow Product managers to configure these charges for each Product variant that is a set of charges can be configured for say a Mortgage Loan and a different set of charges can be configured for Home Loans.