A fascinating behind the scenes look at retail underwriting at scale

Digital Transformation is not just deploying the latest technologies in the enterprise but harnessing technology to solve a functional problem or improve the efficiency of a process. One area where technology can greatly enhance the efficiency is in underwriting credit as in loans. Technology can play a significant part in evaluating eligibility norms and credit norms on an individual or company's application. The result of this evaluation can then be piped into the "Credit Appraisal Memo".

Consider an Individual (Professional or Salaried) whose application for a Personal Loan has to be evaluated. At the very minimum the following eligibility norms should be checked

1. Deduplication

2. Age Check

3. Mobile number available

4. Identity proof available

5. Address Proof available

6. Bank details available

7. Negative Professions

8. Residence Stability

9. Employment Stability

10. Nationality

11. Education details provided

12. Profession Check for SEP

13. Certificates of Practice availabe

14. Registration certificate provided

A financial Institution deals with several types of entities some are people while some others are entities with different holding structures. Identifying a suitable financial product from a portfolio for each of them could be a daunting task if done manually or in a semi automated way. Imagine manually creating the facility limits after manually analysing the financial ratios of an entity! It requires analysing the balance sheets of several years and determing the financial ratios before arriving at the financial limits. Should the financials change then recomputing the limits is a daunting task. Deploying Robotic Process Automation to handle this could make a difference. RPA's greatly enhance the speed and accuracy in which decisions are made.

Featured Resource

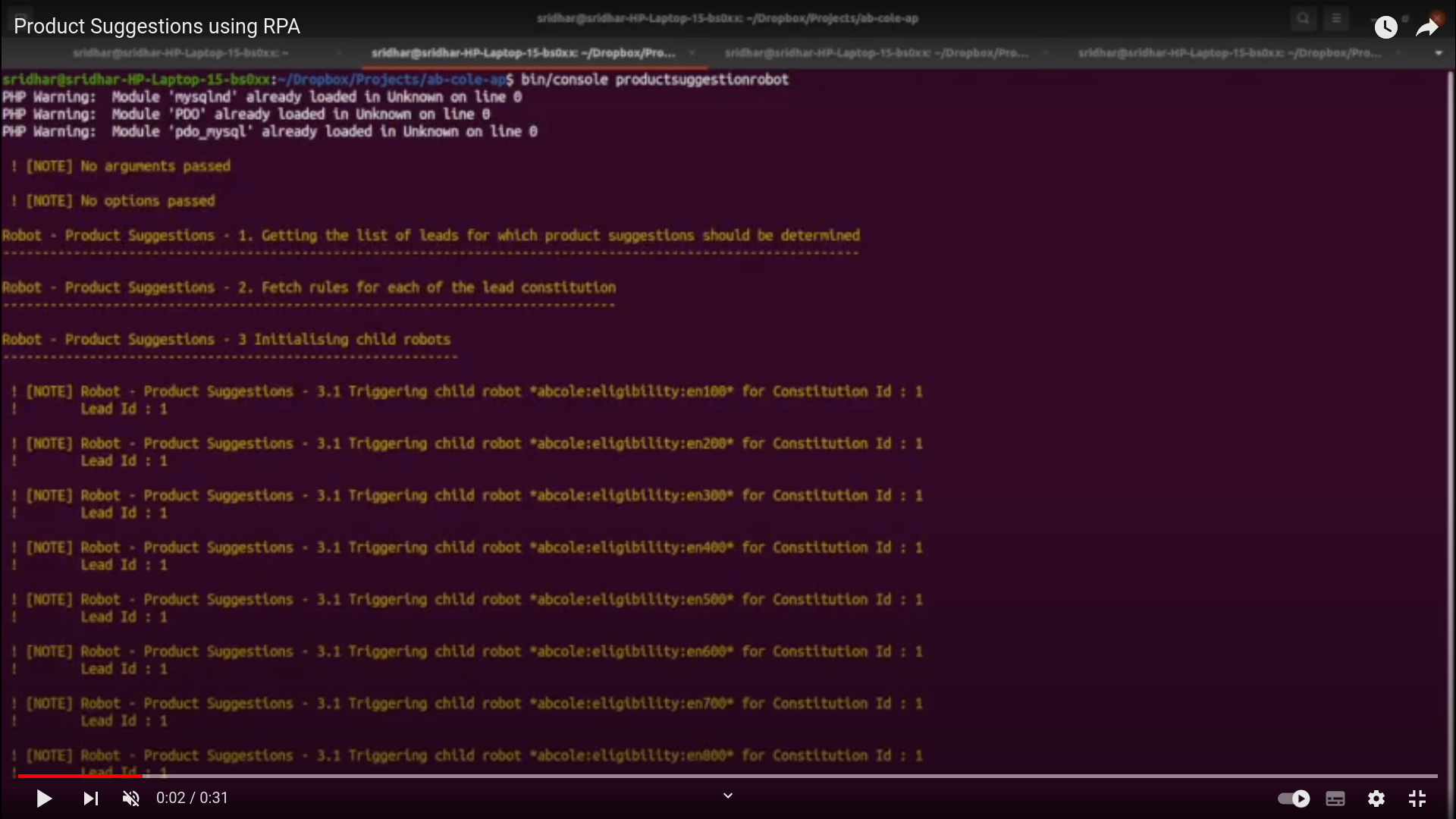

Product Suggestions based using Robotic Process Automation (Video)

RPA allows the norms to be applied across the board with significant reduction in execution time. We work with Financial Institutions where automation of this aspect of the credit workflow has resulted in significant cost benefits. The RPA based workflow allows Banks and FI's to apply norms the borrower and product combination that is being offered. RPA also allows the Institution to determine the sequence in which the norms have to be evaluated. New norms can be included in the sequence or old ones can be removed.

The Anybank platform ships with a repository of robots for eligibility and credit norms. Combined with our Digital Transformation serviceswe are able to offer tremendous value to our clients. If you would like to see how RPA's can make a difference to your credit workflow work please get in touch with the author of this post.