IFTTT Recipes for Banks and NBFCs

We have been fascinated by Marketing Technology or Martech and have been searching the web for tools that will help Banks and NBFC’s increase marketing cadence online. For the uninitiated Marketing Technology is the digitization of Marketing whereby technology is used to achieve the marketing goals and objectives. We have been amazed by the sheer number of ‘no-code” tools that are available.

Of the several that we have evaluated. IFTTT or “If This Then That” seems to be more than just a promising tool. According to the poll by Scott Brinker the author of Chiefmartech the results of which are available here in a survey of 97 respondents, 56% use IFTTT.

What is IFTTT?

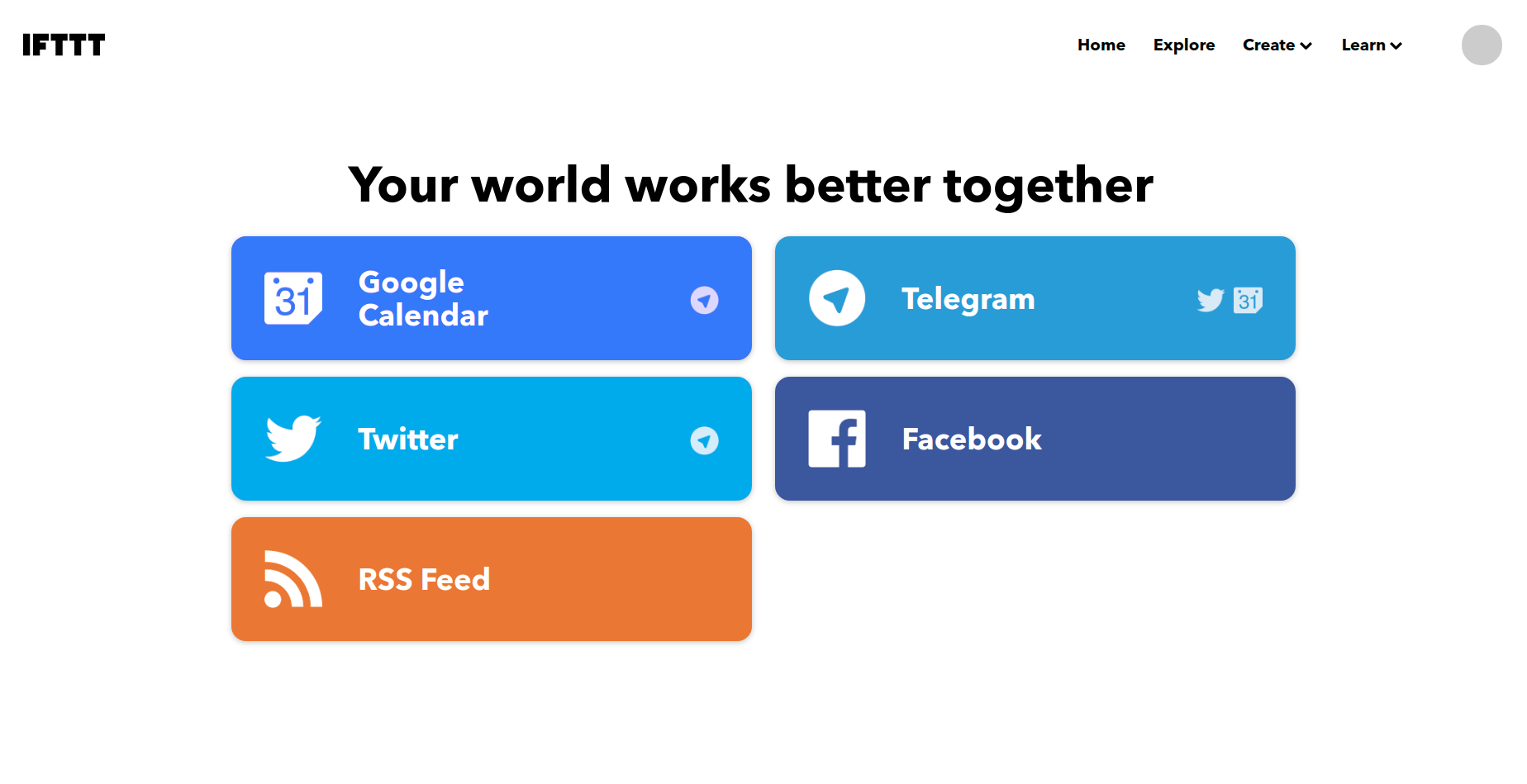

“If This Then That” is a paradigm derived from the world of programming. The company provides a cloud based platform that allows people to connect various applications and services to create workflows for automation, in short it provides the required plumbing between diverse applications, often from different vendors, that are available on the web today. Think of these as macros in a spreadsheet but less complicated and more powerful.

What can you do with IFTTT?

With IFTTT there are several marketing and sales actions that you can automate. For example as an Bank / NBFC you can do the following

- Let’s say that you plan to launch a new “Buyers Credit” product to fund importers of Indian capital goods overseas you can post the advertisement on Facebook and IFTTT will sense it and post it on Twitter for you.

- Lets say that you would like to assess the response to your recent post on Facebook and Twitter on a reduced interest rate on your “Packing Credit” facility for MSME’s. You can tweet this with a hashtag and monitor the conversations on social media using the hashtag to determine of if the response is adverse or beneficial.

- You can monitor the social media cadence of your brand and respond to these in time.

The list of IFTTT applets for marketers can be viewed here. But these applets are just the beginning. IFTTT offers connections and services that allow you to power your marketing stack even further. IFTTT offers users the ability to create their own applets. Here is a video that explains how to create and IFTTT applet.

Connections the next generation of IFTTT

IFTTT has introduced connections the next generation of IFTTT applets. With connections you can connect any publicly available API service. If you have a webform on the site that generates leads for your credit products then you can transfer them directly to AB CAPS the Bank CRM.

AB CAPS the CRM for Banks, Co-operative Banks, Microfinance Institutions and NBFC’s is a cloud based CRM to help sales teams sell financial service products. Its a CRM built with workflows for banks and Financial Institutions.

The Monzo integration that allows customers to take control of their spending and savings and thereby achieve their financial goals. The full post is available at the following link.

Generating Leads, Creating a Sales funnel and managing it

Using the IFTTT applets sales teams can generate a health pipeline of leads from their social media cadence and webforms. Using the IFTTT connections these leads can be transferred to the AB CAPS CRM by connecting to the open banking API that accepts JSON (an industry based web standard for data interchange) based data. The API’s have industry strength authentication and authorization mechanisms. The leads can then be allocated to sales teams or individual sales personnel for tele-calling and follow up. AB CAPS CRM for Banks and NBFC’s provide simple usable interface for call and visit logs thus allowing sales personnel to build their own curated sales funnel. Funnels can be managed and tracked using the track leads and lead history before it is ready for transfer to the Central Processing Cell (CPC) for document collection and further data entry.

Summary

There are several martech tools available and a special mention goes to IFTTT because of its powerful “no code” feature that allows marketers and slaes persons in automating lead generation, management and social media cadence.