Sanction a loan under 5 minutes and disburse in 30 minutes using BPM and RPA

Automated programs have taken over the work of traders in the capital and money markets, Credit underwriters and several other areas, infact programs or software robots have taken over the activities in the fields once dominated by Humans. Any routine task can be automated by software; credit assessment and underwriting is one ripe candidate. Given the fact that more people get to use banking services the cost of having humans process routine tasks gets expensive. Taking a cue from Goladman Sachs who has tasted sucess on the trading floor by reducing the number of traders from 600 to just 2 we can achieve stellar results by implementing a combination of BPM and RPA to assess a prospective lead for credit worthiness.

Robotic Process Automation is at the beginning of the automation spectrum, BPM on the other hand is at the other end of the spectrum where visual notations are used to represent human activities, system functions and interaction among them, as the cognitive capabilities of the tools and technologies increases automation becomes intelligent leading us into the realm of Artificial Intelligence However the focus of this article is to focus on using BPM and RPA to improve the efficiencies in credit decisioning.

What is BPM & RPA?

BPM or Business Process Management is a discipline that allows visual modelling and automation of business activities. Modelling is done using a standard notation called BPMN (Business Process Modelling Notation). During modelling various business activities are combined together to create a flow that results in some tangible action. For example the activities of Scan and Invoice, Approve Payment and Print Cheque create a simple Accounts Payable Flow.

For a Financial Institution like Bank or NBFC the benefits of BPM are tremendous

- Institutions can have a single defined process flow to achieve a desired objective

- A repository of Business Processes can be created and chaos in the organisation can be eliminated

- Day to Day operations become more efficient

- Turn Around Times to achieve an objective improves

- Financial Institutions take a great leap towards digitisation

RPA or Robotic Process Automation is a technology that mimics the actions of humans performing repititive tasks. Let’s say that the job of a back-office executive was to peruse the various loan applications and determine those applications that meet the eligibility criteria then an RPA process can do exactly this a lot faster with a lot more accuracy. Which means if the executive was to process ten applications in a work day then the RPA can achieve a scale of several thousand in a time a lot lesser than a day.

Benefits of RPA

- Functions throughout the year without weekends or Holidays

- Quick trun around times

- Can scale to handle any short term spikes in volume

- Very low scope for errors to creep in the processing

- Reduces the cost of servicing customers

- Manpower can move up the value chain to perform innovative work like analysis

BPM and RPA when Implemented together in a Financial Institution could achieve a scale of operations that is unprecedented in the industry today leading to tremendous costs savings and hence impoovements in profitability. RPA can be used in the lending industry in

- KYC Compliance

- Credit Decisioning

- Fraud Detection

- General Ledger

- Report Generation

Credit Underwriting

In the last few weeks the Financial Industry has seen Funding pressures owing to the increase in the cost of borrowing, this automatically decreases the spreads of the companies engaged in any form of lending, though the Banks have been spared this pain a lot of NBFC’ and MFI’s have been experiencing shrinking margins and see challenges in raising funds. On the other hand the expenses on staff and premises increase with every step taken at business expansion. The chances of enduring in such a challenging environment is rather questionable. The answer to this could lie in automating the workflow using BPM and RPA and relying on human talent only for decision making in grey areas.

In the credit department of any financial institution the primary job of the staff is to compile the data of the person so that underwriters can evaluate these and take a decision on whether to lend or not. This job includes accessing multiple systems and service providers and enter these into the systems of the Financial Institution. Usually the minimum TAT to achieve this is about a couple of hours.

Increasing regulatory compliance and greater scrutiny by the central bank has driven the costs of ensuring compliance. Infact the costs of Loan Origination have increased rapidly and are about three times higher than they were in 2010

Leveraging BPM and RPA the standard process of credit decisioning and the rules required for them can be modelled visually and deployed. Automating Repeatable tasks using BPM and RPA the process of data assimilation, Eligibility, Credit policy and Risk check can be completed in a few seconds. This frees up people to work on other areas. Applications like this called “Virtual Underwriters” or “Robotic Underwriters” driven by the underlying BPM and RPA are faster and more accurate than the human counterparts.

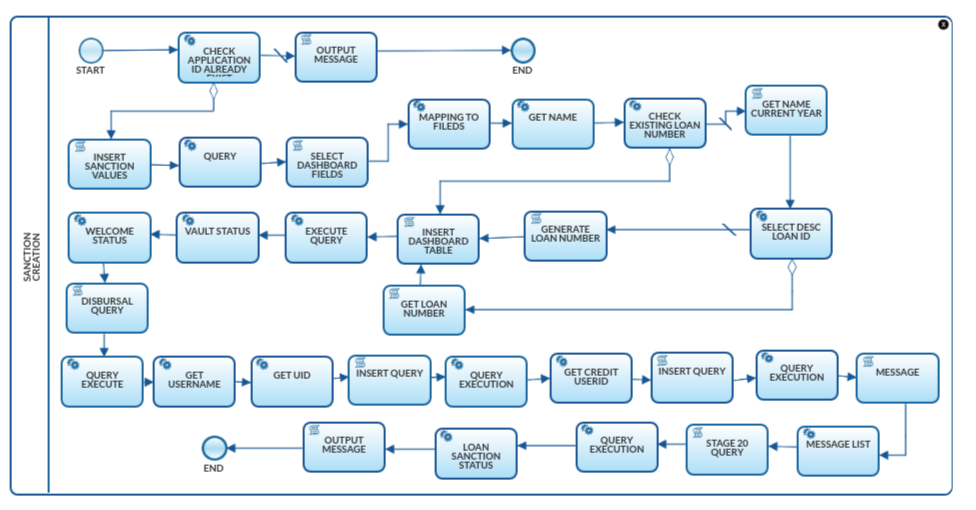

The figure below shows the BPMN model for Credit Decisioning.

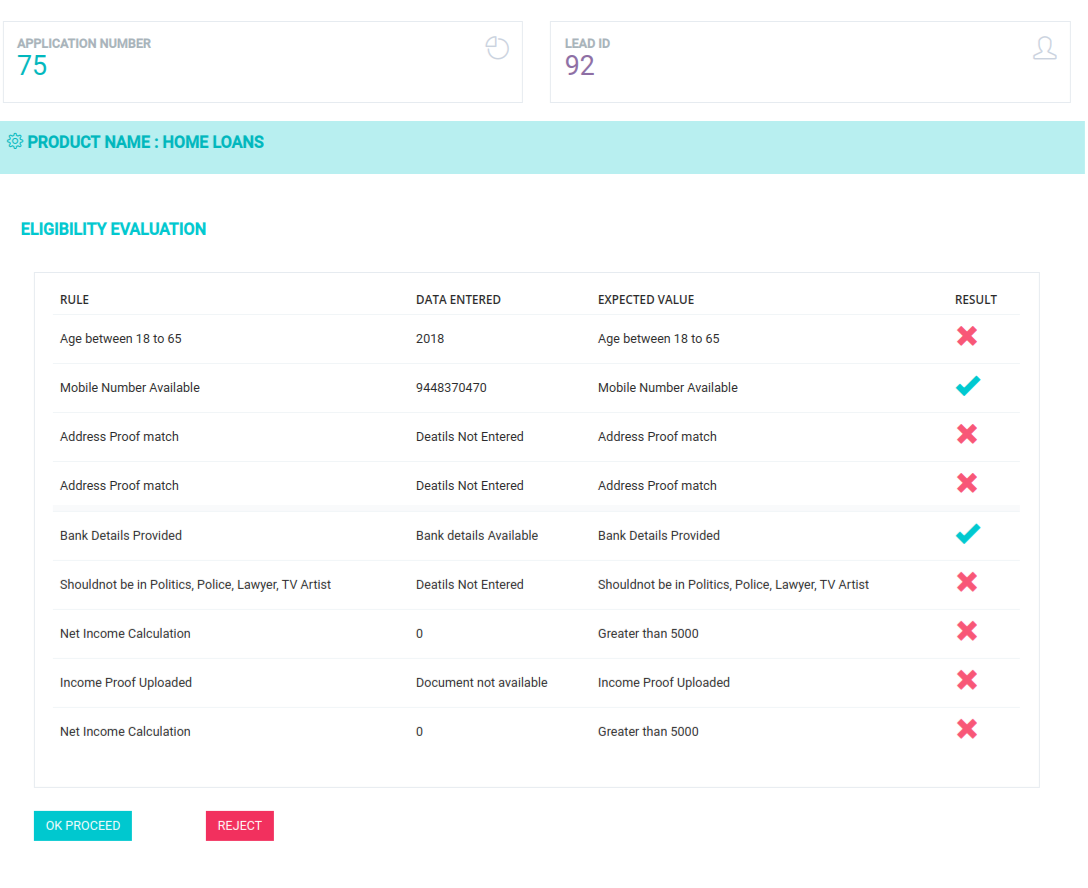

And when this workflow is executed the results that the credit manager views is given in the figure below.

Given the processing accuracy achieved in employing BPM and RPA, Financial Institutions can target unaddressed segments of the society like Students, Persons with low credit scores,

Conculsion

By combining BPM and RPA Financial instituions can process loan applications much faster and more accurately. Some Banks and Financial Isntitutions have already implemented BPM and RPA and have achieved immediate business benefits like effort and cost reduction. Taking the Digital Startegy to the next level will be newer technologies like Artificial Intelligence and Machine Learning that can predict the probability of default of the customer. According to the report published by RBI, “It is said that 'technology becomes truly useful when it becomes invisible...With the change that banking has seen in the last 20 years, it is difficult to say how it'll look like in the future. Although the essence of banking, which is collecting money from those who have surplus savings and using it to lend to those who need it, will remain unchanged, what the customers and the bank staff will experience may be transformed by FinTech.”

References

- Byrnes, Nanette. As Goldman Embraces Automation, Even the Masters of the Universe Are Threatened. February 7, 2017. https://www.technologyreview.com/s/603431/as-goldman-embraces-automation-even-the-masters-of-the-universe-are-threatened/

- Kalpesh J. Mehta, Abhijit Bandyopadhyay, Monish Shah. Banking on the Future: Vision 2020, CII-Deloitte. https://www2.deloitte.com/content/dam/Deloitte/in/Documents/financial-services/in-fs-deloitte-banking-colloquium-thoughtpaper-cii.pdf

- Report of the Working Group on Fintech and Digital Banking, Reserve Bank Of India. https://rbi.org.in/scripts/PublicationReportDetails.aspx?ID=892

- Indian Banks Association, E&Y. Banking of the Future: Embracing Technologies. February 2018. https://www.ey.com/Publication/vwLUAssets/ey-banking-of-the-future-embracing-technologies/$FILE/ey-banking-of-the-future-embracing-technologies.pdf.

- Keshav R Murugesh. Reimagining the rise of Robots , The Financial Express. August 2016. https://www.financialexpress.com/opinion/robotic-process-automation-the-next-big-disruption/344032/